A Breakthrough in Mortgage Technology Innovation

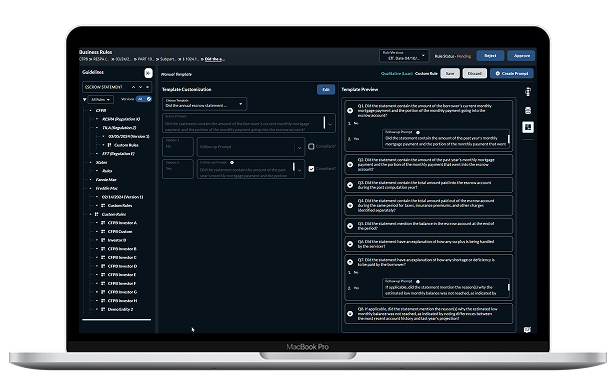

VAIDA was developed in just 24 months and trained specifically for the mortgage ecosystem using deep learning techniques. It reads, interprets, and comprehends mortgage documents, servicing and origination guidelines and regulations, and internal servicing policies and procedures with extraordinary accuracy in minutes. It’s the power behind the Livegage solutions engineered to address the technology challenges and product gaps facing the most complex debt asset class: residential mortgages.

The Livegage product suite harnesses the power of AI to:

Accelerate Regulatory Change Management

Automate Investor Accounting and Servicing Fee Calculations

Beat “the blob” with intelligent document classification and data extraction

Significantly Reduce Default Timelines

Increase retention and recapture rates

Revolutionize Your Compliance and Risk Management Operation

Power predictive servicing insights and investment analytics

Drive higher returns on your MSR & Whole Loan Portfolio

Enhance the customer journey and increase retention and recapture rates

Eliminate the reactive nature of exception management

Substantially lower your corporate costs, run your business more efficiently, exponentially reduce your regulatory and compliance risk, automate your accounting operation, and more, with an industry-disrupting suite of products built by experts in mortgage servicing, data science, analytics, and fintech software engineering.

SOC2 Type2 Certified

Livegage takes information security seriously. We adhere to industry-recognized standards and are a SOC2 Type2 Certified organization. Our information security team has extensive experience implementing systems, as well as tested practical skills and extensive knowledge of best practices.